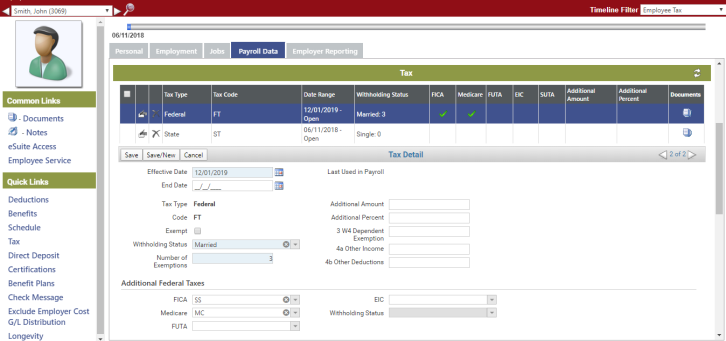

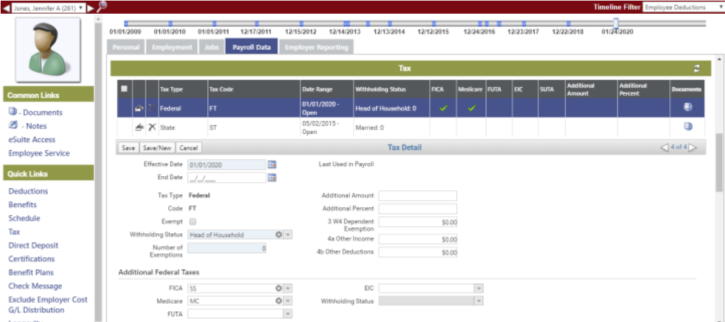

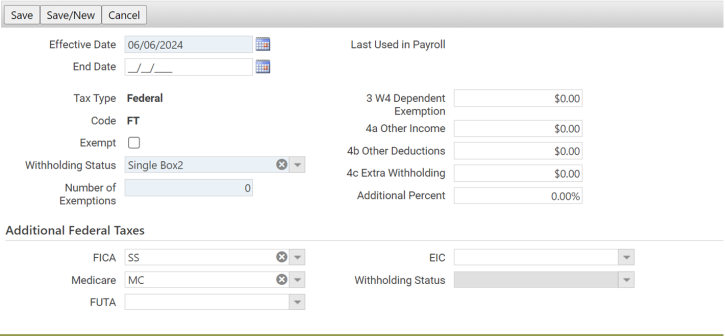

Human Resources > Workforce Administration > Search > Employee Number > Payroll Data

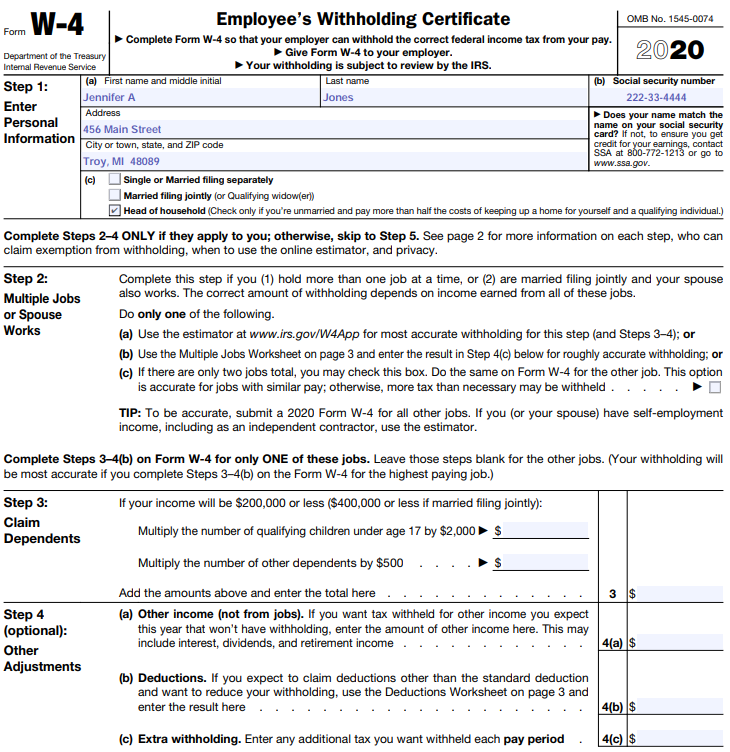

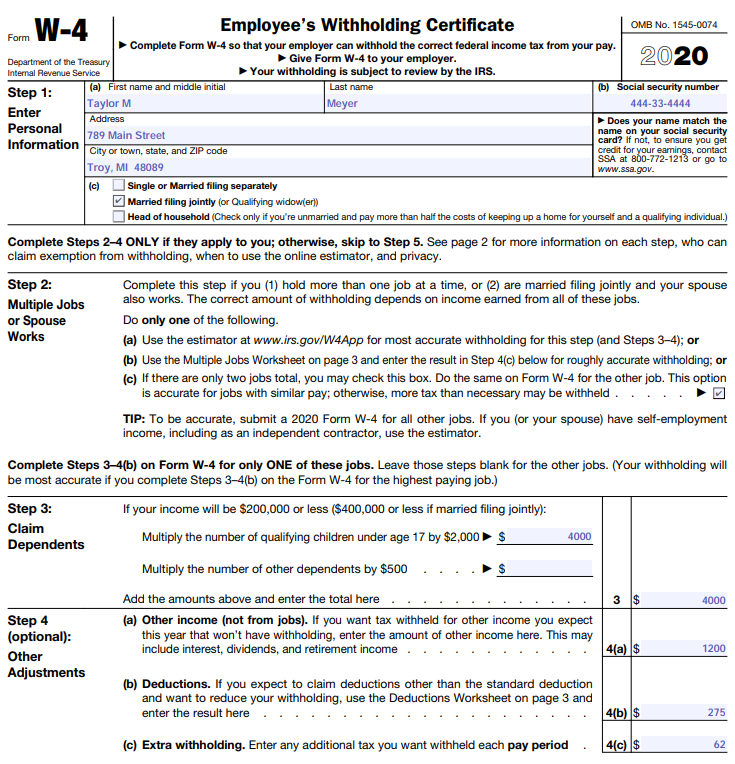

Beginning in 2020, Workforce Administration needs to support two different forms for the W-4: the old one used in 2019 and earlier with a number of allowances and the new one used in 2020 with multiple jobs (step 2), a dependent amount (step 3) and other adjustments (step 4).

The way the system differentiates the two methods is, if an amount is entered in any of the new fields (3, 4a or 4b), the new calculation occurs. If those three fields are left blank, the old calculation occurs. In either case, the Number of Exemptions field is required, but if any of the new fields contain an entry, the number of exemptions is ignored. It is also important to select the correct withholding status to reflect whether the box in step 2c is selected.

There is one item to note from the final release of the tax calculation on 12/20/19 . It indicated that when the employee’s status is single or head of household and the box in step 2 is not selected, their gross wages should be reduced by $8,600. And when the employee’s status is married and the box in step 2 is not selected, their gross wages should be reduced by $12,900. A button was added in releases 2019.1.28 and 2018.1.42 to allow for setting up these amounts on the federal tax in Maintenance. If you are on an earlier release, these amounts should be added to line 4b to achieve the correct tax calculation.

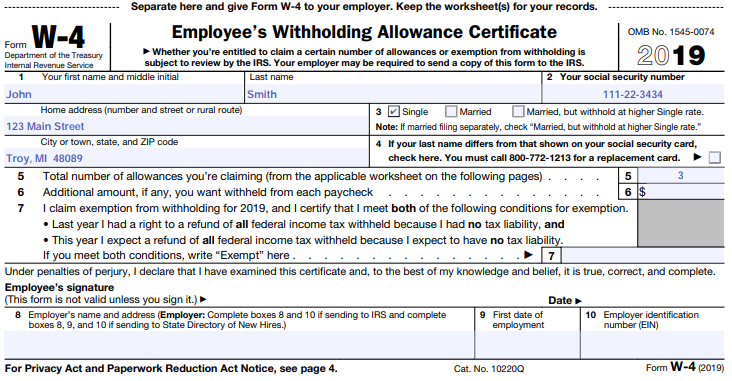

Here are some examples of how to correctly enter a W-4 form in order to calculate the appropriate federal taxes:

Workforce Administration would be filled out as shown below: